are political contributions tax deductible in oregon

While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns. While ActBlue is organized as a political committee we act as a conduit for individual contributions made through our platform we do not make contributions ourselves.

Are My Donations Tax Deductible Actblue Support

Arkansas residents can get a 50 tax credit per taxpayer so 100 for a couple filing a joint return for cash contributions made by the taxpayer in a taxable year to one or more of the.

. However donations to ActBlue Charities and other registered 501 c 3 organizations are tax deductible. Are Political Donations Tax Deductible. This screen will be seen after the Adjustments Summary screen.

If he files a joint return with his spouse they may claim a 100 credit. The following are examples of the various types of contributor searches that may be conducted. Gambling losses claimed as itemized deduction 604 Federal estate tax 605 Federal mortgage interest credit 607 Federal tax credits 609 Child Care Fund contribution 642 Oregon Production Investment Fund contributions 644 University Venture Development Fund contributions 646 Oregon IDA Initiative Fund donation credit add-back 648.

The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations. We process and send grassroots donations to the campaigns and organizations that use our. The Commission maintains a database of individuals who have made contributions to federally registered political committees.

This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible. Oregon State Political Contribution Credit rcsroper Although you can enter the contribution in TurboTax even if your income is over 150000 it will be flagged when the mandatory review is done before you file your tax return and you will need to. These business contributions to the political organizations are not tax-deductible just like the individual donations and payments.

States which offer a tax credit not tax deductions to political donations include. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. 3 Contributions to candidates.

To be precise the answer to this question is simply no. A business tax deduction is valid only for charitable donations. Montana offers a tax deduction.

While no state lets you deduct political contributions four of themArkansas Ohio Oregon and Virginiaactually do something better. Political contributions deductible status is a myth. Political contributions are not tax deductible though.

Oregon deduction for taxes paid to Maine by 12000. On the other hand Montana provides tax deductions on state-level income tax for political donations. Data on individual contributors includes the following.

Individuals cannot deduct contributions made to political campaigns on their federal tax returns regardless of whether they itemize or claim the standard deduction. Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost. Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction.

You can confirm whether the organization that you have been choosing for your donation. Search an individual contributor by their. You cant deduct a charitable contribution for which you received an Oregon tax credit as a payment of Oregon.

However four states allow tax breaks for political donations to candidates or parties. They offer a tax credit for part or all of your contribution up to a certain amount. Likewise gifts and contributions to 501 c 4 social welfare organizations are not deductible as charitable contributions.

All contributions qualify for the political contribution credit. As of 2020 four states have provisions for dealing with political contributions. It is not deductible for Federal.

However in-kind donations of goods to qualified charities can be deductible in the same way as cash donations. Political donations to federal candidates and committees are not deductible from federal income taxes whether they are made online or in person. Arkansas is one of just four states the others are Ohio Oregon and Virginia that gives citizens a tax credit for donating to a political candidate.

If youre wondering what your current contributions to a political campaign party or even cause mean for your taxes youre not alone heres what you need. Jim will be able to claim a credit of 50 on his 2012 income tax return. Under the law contributions made through ActBlue are not considered PAC donations.

Shell report 16000 28000 12000 on Schedule OR-A line 5. You cant deduct political contributions dues paid to fraternal organizations or the value of any services or benefits you received in connection with. Charitable contributions claimed as Oregon tax payments.

Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible. When you are in the State Taxes section for Oregon there is a screen titled Political Contribution Credit where you are able to enter the amount of your Oregon political contributions you are referring to.

Help Us Distribute The Christian Voter S Guide Oregon Family Council

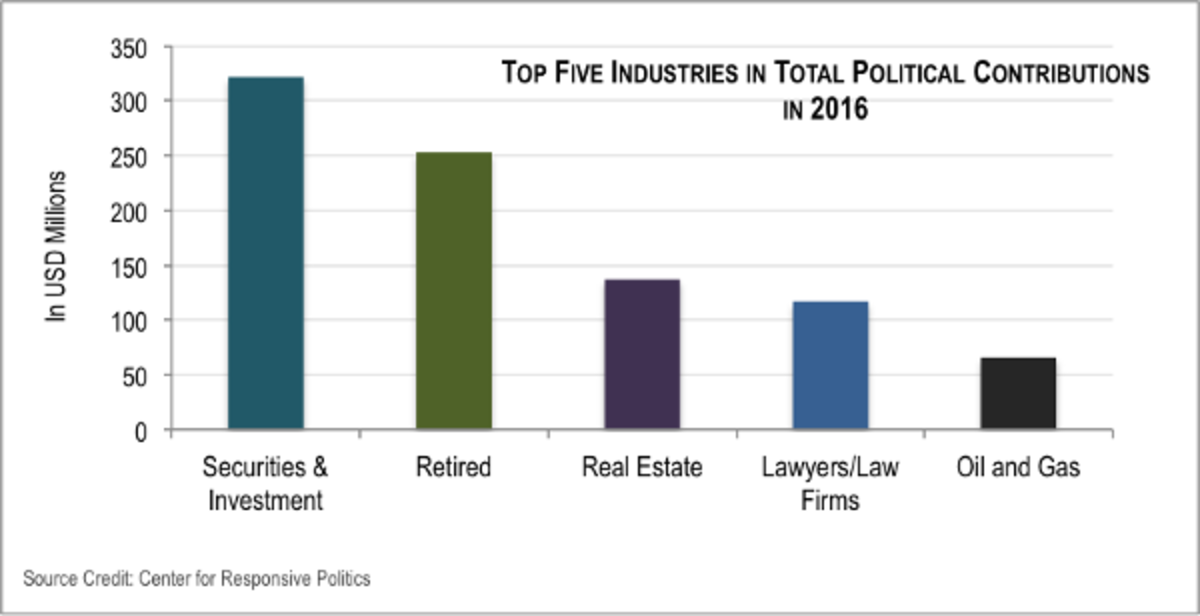

Here Are The 5 Industries Spending The Most On Political Donations Thestreet

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Are Political Contributions Tax Deductible H R Block

Money S Power In Politics Give Everyone A Share Cnn

States With Tax Credits For Political Campaign Contributions Money

/hard-money-soft-money_final-0223d3d452a049dc95a8a05b20c9142a.png)

Hard Money Vs Soft Money What S The Difference

Why Political Contributions Are Not Tax Deductible

Are My Donations Tax Deductible Actblue Support

Donate Oregon Right To Life Pac

Why Political Contributions Are Not Tax Deductible

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible H R Block

![]()

Are My Donations Tax Deductible Actblue Support

Why Political Contributions Are Not Tax Deductible

Are My Donations Tax Deductible Actblue Support

Why Political Contributions Are Not Tax Deductible

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits